NEWS

BREAKING: European Union Blocks Trump’s Trade Deal in Retaliation for Tariffs – U.S. Treasury Bonds They Hold Worth Trillions Threaten Financial Shock, and Trump’s 5-Word Response Could Hit Americans Hard

In a stunning escalation of economic tensions, the European Union has blocked a major trade deal with the United States in response to sweeping tariffs imposed by President Donald Trump. What began as a contentious negotiation over duties on steel, aluminum, automobiles, and other goods has now turned into a full-blown transatlantic standoff that threatens financial stability on both sides of the Atlantic.

The tariffs, part of Trump’s strategy to protect American industry and counter what his administration calls unfair trade practices, have drawn fierce criticism. European leaders argue that the levies are coercive and could provoke a crippling trade war with the United States, its largest trading partner. The EU’s decision to block the deal reflects a refusal to bow to economic pressure and underscores the growing friction in what has long been a delicate relationship.

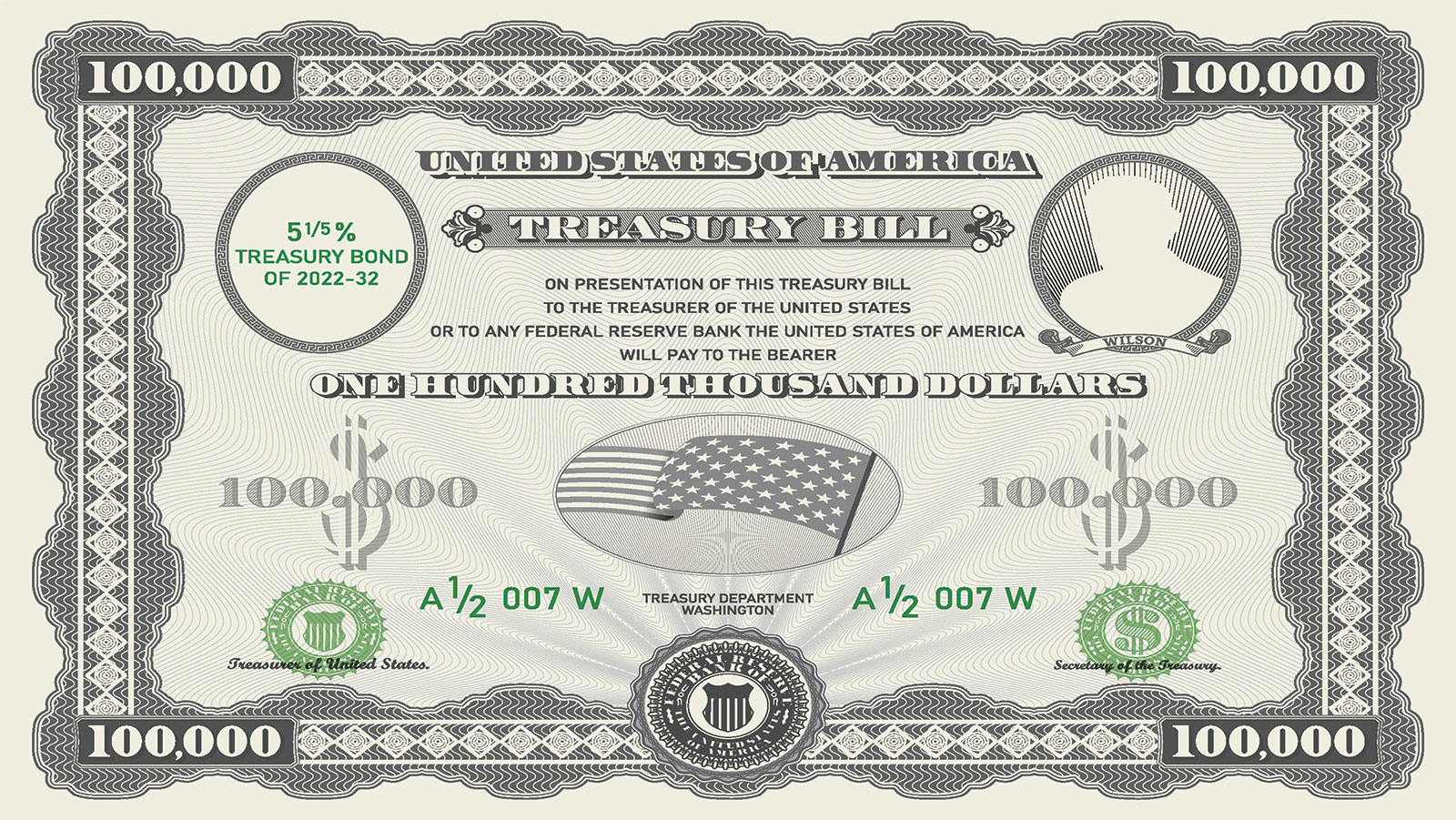

At the center of the dispute are the trillions of dollars in U.S. Treasury bonds held by the European Union, a critical pillar of global financial stability. Analysts warn that even the threat of Europe selling or reallocating those holdings could send yields skyrocketing, weaken the dollar, and stoke inflationary pressures that Americans are already feeling in their everyday lives. The stakes extend far beyond politics — they strike at the heart of the American economy.

The disruption has already had tangible effects. Markets dipped as investors reacted to the uncertainty, while manufacturers began adjusting supply chains to avoid punitive tariffs. European leaders have made clear they will not compromise on principles of sovereignty and economic independence, sending a message that global power dynamics are shifting.

Amid the turmoil, President Trump issued a brief but powerful statement that has dominated headlines and social media: “We’re fighting for American jobs.” Those five words captured the essence of his approach, energizing supporters while raising concerns among economists who warn that the long-term consequences for employment, investment, and inflation could be far more complex and damaging.

Washington is now on edge. Some lawmakers have praised Trump’s tough negotiating stance, while others fear a protracted dispute with Europe could jeopardize American businesses, strain alliances, and destabilize international markets. Behind closed doors, negotiations continue, but trust is fraying, and strategic leverage is shifting at a rapid pace.

As the story unfolds, one question looms larger than any other: if Europe’s blockade holds and financial markets begin to wobble, is the United States prepared for the shockwave that could ripple through the economy and touch every American household?