In the heart of Pacific Palisades, where luxury meets the coastline, a devastating wildfire recently tore through the community, leaving destruction in its wake. Among those affected was the legendary Hollywood actor, James Woods. Known for his intense performances in films like “Once Upon a Time in America” and “Casino,” Woods found himself in a real-life drama when his home was engulfed by flames.

The wildfires, which swept through Los Angeles with terrifying speed, claimed multiple structures and forced thousands to evacuate, including several high-profile celebrities. Woods was one of the many who had to flee his home, but his story took a particularly bitter turn due to an issue with insurance coverage. In the aftermath, Woods took to social media on 𝕏, revealing a concerning detail: a major insurance company had canceled all policies in his neighborhood approximately four months before the fires erupted.

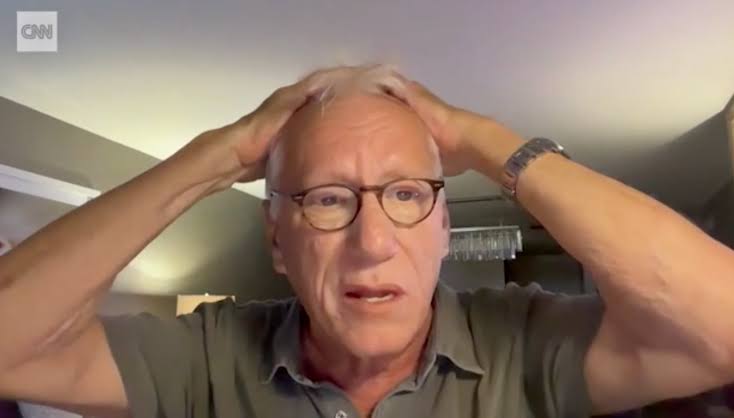

Woods, visibly shaken in interviews following the incident, described the scene as akin to “losing a loved one.” He shared on CNN how his home, a sanctuary he had renovated post-COVID, was now reduced to ashes. The emotional toll was evident as he recounted how his wife’s young niece offered her piggy bank to help rebuild their life, a gesture that brought him to tears. His posts on 𝕏 were filled with updates from the ground, showing the rapid spread of the fire and thanking the first responders for their heroic efforts in the face of such adversity.

This insurance cancellation, as Woods claimed, adds another layer of complexity to the tragedy. The cancellation of insurance policies in wildfire-prone areas like California has become increasingly common due to the rising risk of such disasters, attributed to climate change and inadequate fire management. Woods’ situation highlights a critical issue: the vulnerability of homeowners when insurance companies pull out of high-risk areas. His neighborhood, filled with multimillion-dollar homes, was left without the financial safety net that insurance provides, right before a catastrophic event.

The actor’s claims on X spurred a wave of reactions from the public, with some expressing sympathy and others questioning the timing and motives behind the insurance company’s decision. Posts on 𝕏 reflected a mix of support for Woods, criticism of insurance practices, and calls for better fire management policies in California. This incident has reignited discussions on how insurance companies manage risk in an era marked by increasingly frequent natural disasters.

The broader implications of Woods’ ordeal touch on the balance between profit and protection in the insurance industry. Without insurance, those affected by fires face not only the immediate loss of their homes but also significant financial and emotional recovery challenges. The insurance cancellation in Pacific Palisades might be a harbinger of future issues for homeowners in wildfire-prone regions, prompting a need for both regulatory oversight and innovative insurance solutions.

As the community begins to rebuild, both literally and metaphorically, the story of James Woods serves as a stark reminder of the fragility of our living environments in the face of natural disasters and the policies that govern our security. His experience underscores the urgent need for a dialogue on sustainable living, better disaster preparedness, and a reevaluation of how insurance companies operate in areas where the risks are escalating.

In the end, while James Woods has faced this Hollywood tragedy with the resilience one might expect from a seasoned actor, his struggle is a microcosm of a larger issue facing countless others in similar situations. His voice, amplified by his celebrity, has brought attention to an issue that might otherwise remain in the shadows of policy discussions, urging for changes that could protect future generations from the same fate.